- Policy

- Posted

Pay as you save

In an ideal world every occupied building in Ireland would be energy upgraded to the highest standard, tapping into numerous benefits for the building occupant, the construction industry and society as a whole. Construct Ireland is calling for the introduction of pay as you save, a repayment model which offers the potential of making significant energy upgrade investments achievable in the vast majority of Irish buildings, as Jeff Colley reveals.

If money were no object, virtually every occupied building in Ireland should be energy upgraded to cutting-edge levels. Numerous benefits would be felt across society, including cutting Ireland’s annual e6bn energy import bill, reducing carbon emissions and associated costs, creating exportable green skills and technologies which could drive our economic recovery, and improving the health, well-being and productivity of Irish people due to the resulting improvement in living conditions.

But the hard truth is that money is an issue, both in terms of the public purse and the Irish people in general. Sustainable Energy Ireland’s Home Energy Saving scheme, still in its infancy, may well have a quoted budget of e49m for this year, and may even succeed in keeping its overall budget of e100m over the next few years. The e50m pledged for energy upgrading low income housing this year, and the e12m Greener Homes scheme budget for installing renewable heating systems may also be spent. However, if an Bord Snip’s recommendation that SEI’s budget should be cut by e40m is realised, that clearly points towards a drop in the amount of funding available to subsidise the greening of Ireland’s building stock.

Another problem which may affect SEI’s budgets for their various schemes is the difficulty in getting Irish people to apply for grants. The low income sector excepted, where 100 per cent of the cost of energy upgrade measures is covered, albeit for a limited number of buildings, it may prove difficult to persuade Irish homeowners that grants of roughly 30 per cent justify covering the rest of the cost of paying for energy upgrade measures. This is understandable. With no imminent sign of price increases in the energy market, and little chance that carbon tax will be set at a high enough level to force substantial change it may be difficult to convince people that they should pursue an energy upgrade. In conditions like this, it may only be a motivated minority of people concerned about climate change or the health issues of living in damp, draughty buildings who are prepared, finance permitting, to invest in energy upgrade work. Even these people may be disenfranchised by the confusion of conflicting advice on which options will save most energy, and by stories of upgrade attempts gone wrong.

Obstacles of this nature must be overcome if any significant volume of energy upgrade work is to be realised. Construct Ireland believes that there is a realistic route to addressing these problems and substantially energy upgrading the vast majority of buildings in Ireland – an approach developed in the US called Pay As You Save (1) (PAYS). This approach, developed by Harlan Lachman and Paul A Cillo of Vermont’s Energy Efficiency Institute over the last decade, places little or no requirement for state subsidy in the form of grants or any other fiscal measure, and eliminates all disincentives to anyone investing in efficiency technologies in their building, whether they’re the owner or tenant of the home, office or any other building type in question. It can also be used to cover the cost of achieving high levels of energy efficiency in the construction of new buildings, although perhaps only in cases where prompt occupancy can be proven.

How does PAYS work?

In short, PAYS offers people the opportunity of energy upgrading the building they occupy, without requiring them to provide upfront finance and without placing a debt obligation on them. A PAYS tariff is instead assigned to the building through a utility bill. Customers who sign up to a PAYS tariff see an immediate financial benefit, as the repayment tariff is set up to cost less than the amount of energy that the customer has avoided using. For instance, if a customer uses PAYS to reduce their annual energy bills by an estimated e1000, the PAYS tariff would cost e750 – a net saving of e250.

Under PAYS, the repayments for the energy upgrade work on an energy bill would always be lower than the cost reduction caused by the energy savings achieved. To achieve this, Lachman and Cillo developed what they call the ¾ - ¾ rule. Firstly, the amount of the monthly payment cannot exceed three quarters of the estimated saving, which means that the customer will get immediate financial savings – even if their savings estimates are off by as much as 25 per cent. Secondly, the payment term for PAYS products cannot be longer than three quarters of the measure’s estimated life – thereby ensuring that customers don’t keep paying for technologies that they no longer use.

The payment obligation is attached to the property through the electricity meter rather than to a specific owner or occupant. A PAYS tariff is included on the energy bill until all costs associated with installing the measures have been repaid, including repairs, missed payments, interest, programme fees, and so on. If the occupancy of the property changes hands, the new occupant who receives the savings from the installed measure assumes the obligation to pay the PAYS tariff on their energy bills. If there’s a gap between occupancies, the repayment period is extended accordingly.

Paul A Cillo and Harlan Lachman of Vermont’s Energy Efficiency Institute, the originators of PAYS

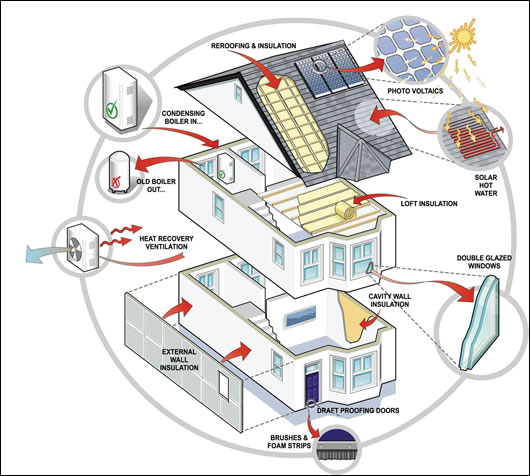

Construct Ireland proposes that the government should encourage or even mandate state-owned energy utilities and private energy suppliers to offer their new and existing customers PAYS tariffs. The cost of the work would be assigned to the energy bills of the customer, and repaid over an agreed period of, typically, from five to twenty years or so. The actual amount and term is determined by the cost, savings potential and expected lifespan of the measures, and to what both the customer and energy company are prepared to accept. In all cases, the reductions in estimated energy costs are greater than the repayment costs on the upgrade work. In the case of homes, this might typically involve installing measures ranging from costs of a few thousand euro up to twenty thousand euro or so, with larger investments justified in buildings with higher energy consumption. Any energy saving measure, including a vast range of materials and technologies could be included within a PAYS tariff, if it can be proven that the measure will save sufficient energy over its expected lifespan to prove cost-effective within the terms of the tariff. This could include anything from CFLs, to various forms of insulation, to heating system replacement to microgeneration of electricity. Customers could even use such a tariff to make incremental improvements over time. For instance, initially the tariff could include a repayment for CFLs over, say one year, along with cavity and attic insulation over, say, three to five years. Perhaps after feeling the benefit of the insulation over a couple of years, the customer might like to add a boiler replacement and solar thermal to the tariff over five to eight years or so. Ten years down the line they may wish to use a PAYS tariff to help make their house carbon neutral. PAYS therefore offers the prospect of creating a continuous demand for innovative technologies to meet customers needs in a changing energy (and climate) landscape.

Are there any precedents for this?

There are. In the aftermath of the 1979 oil crisis, ESB and Moy Insulation teamed up to offer attic insulation to customers, requiring no upfront capital investment, but instead adding the cost to the energy bills of the participating customers. Roughly 30,000 attics were insulated on this basis, and the scheme was commercially successful. Similarly, the rural electrification of Ireland led to ESB opening shops over time and offering hire purchase on a broad range of appliances. Often this was a last resort for credit for many people, as their likelihood of defaulting was cut by their need for continuing energy supply.

The Energy Efficiency Institute developed PAYS in the late 1990s. Programmes based on PAYS have been successfully implemented by six utilities in Kansas, Hawaii and New Hampshire – no mean feat given that this was achieved during the Bush administration years in a country with umpteen different utility regulators. Hundreds of customers at New Hampshire Electric Cooperative paid full cost for compact fluorescent light bulbs and several customers weatherised their homes and businesses, including the installation of improved heating, ventilation and air handling equipment. Municipal customers at the Public Service of New Hampshire implemented hundreds of efficiency projects, especially lighting and street lighting retrofits. More than 200 customers in Hawaii Electric Company’s subsidiaries installed solar water heating systems, including many who had previously rejected offers. Midwest Energy has had 150 customers use its PAYS tariff to install insulation, new windows, and efficient heating systems.

More recently, PAYS is being considered in Japan and the UK. Both the Labour government and the Conservative party `have recently backed PAYS as a proposed financing mechanism for low carbon refurbishment in the household sector, with the UK Department of Energy and Climate Change’s recently announced Low Carbon Transition Plan including a commitment to the piloting of PAYS. Central to the UK version is the idea of spreading the cost of refurbishment for a property over a substantial period of time, and across different owners. A UK Green Building Council task group (2) has just published a proposal on overcoming the barriers to practical implementation of PAYS on its website.

Interestingly, the Department of Communications, Energy and Natural Resources has just gone out to consultation on a programme that could encourage the energy supply sector to adapt their business models to incorporate PAYS. The department is proposing that the programme, to be called the Energy Demand Reduction Target (EDRT), may involve passing a law forcing the energy supply sector to substantially reduce the amount of energy consumed in Ireland, with a particular focus on stimulating end-use efficiency. (3)

The state should use the EDRT to set a mandatory energy and carbon reduction target for the energy sector to achieve, whilst encouraging energy suppliers to come up with solutions which prioritise end use efficiency. It could even help their decision by facilitating cost-effective finance for energy efficiency work through issuing green bonds, for instance. Energy suppliers would be faced with two different approaches:

1) Invest in replacing inefficient power generation at their own risk, and pass the cost on to all of their customers through higher energy bills. Their customers may resent the cost increases, especially if they live or work in particularly inefficient buildings – they may feel that efficient generation is of little use to them if their building is too energy inefficient to hold on to heat. One very obvious drawback here is that substantial gains would only be possible in the electricity sector, where efficiency gains could be made through investing in new generation and to a lesser extent transmission technology. There’s little that can be done to improve the primary energy factor for gas, oil or solid fuels, on a system wide basis, as the conversion of the fuel into heat or electricity(4) occurs in the customer’s building rather than a central power station.

UK secretary of state for energy and climate change Ed Milliband, who announced plans to pilot PAYS in the Low Carbon Transition Plan

2) Invest in helping their customers to use less energy/carbon, by adding the cost of upgrading the building to the occupant’s energy bill (therefore, the cost is only added to the bill of participating customers rather than all customers). The occupant would therefore have a more comfortable, healthy building which can hold onto heat. The repayments of the energy upgrade would be assured to be lower than the estimated energy savings, and the occupant would benefit from even lower energy bills once the upgrade has been fully paid for. From that point the building owner may ultimately benefit from an increased resale value. For utilities with aggressive savings targets, rebates could be added to convince occupants to install additional measures that might not have sufficient savings to pay for themselves with immediately positive cash flow. For instance, let’s assume a house is upgraded at a cost of e8000, where only, say, e5000 is viable within a PAYS tariff. The state may come in with a subsidy to cover the extra e3000. Alternatively, the utility could pay the subsidy based on buying the client’s carbon savings over a number of years.

Especially if their risk is addressed, the energy sector should come to the conclusion that the second option has far greater economic benefits for their own business and for their customers. As far back as 2006 the International Energy Agency (IEA) estimated that, on average, $1 spent on more efficient electrical equipment, appliances, and buildings avoids more than $2 of investment in electricity supply. (5) Up till now, the Irish energy utilities haven’t found a way of profiting from this equation. PAYS would change that, enabling the utilities to secure a guaranteed income into the medium to long-term, simply by enabling their customers to use less energy.

How would PAYS be financed?

There are three options which wouldn’t involve drawing down money from the government coffers: setting up green bonds, relying on the utilities to provide finance, or allowing third parties to bid to provide capital. If the utilities are required to guarantee payment to the capital provider regardless of collections, there will be a surfeit of potential bidders.

The government could set up a green fund, perhaps under the auspices of the National Treasury Management Agency, and fund it by issuing green government bonds. Those green bonds would offer a low but secured rate of return, and all monies invested in these bonds would be ring-fenced for green projects in Ireland, such as PAYS projects. This money would be used by the utilities to pay the upfront costs for approved energy upgrade work for projects using the PAYS principles, therefore offering occupants a low, secure interest rate and making the prospect of committing to repaying this over a long period of time attractive.

It’s worth pointing out however that PAYS stands up even without the establishment of green bonds, for a couple of reasons:

1) The energy utilities should have no problem arranging competitive financing of their own accord, as they represent a low risk – they’re experienced and their debt is spread across hundreds of thousands of customers, each paying comparatively small, manageable amounts.

2) It’s to be expected that the upgrade work would be spread over several years. Whilst the total value of the market for substantially energy upgrading much of the Irish building stock would total tens of billions of euro, it would take time to develop the market to its full potential. For instance, the target in year one might be to upgrade, say, 20,000 homes with upgrades costing on average circa e5 to 20,000, rising to up to 100,000 homes once PAYS programmes are fully up and running. The requirement for upfront capital for PAYS would be relatively small (compared to replacement of power generation for instance) at any given time.

3) If utilities spread out the risk of non-payment to all customers and guarantee repayment to independent third party capital providers regardless of their collections, third parties will want to bid to provide capital. The default rate from the existing PAYS programmes in the US has been substantially less than one percent to date – three one-thousandths of one percent of the cost of installed measures. In a market with few risk averse opportunities to make a single investment that benefits tens of thousands of individuals and their communities and the environment, there will be no lack of bidders.

Nonetheless, the green bonds option should be pursued. Let’s assume the ambition is to achieve a substantial energy upgrade through a PAYS type model, where the capital repayments are less than the estimated reductions in energy costs. Let’s also not assume increases in energy costs. Some more costly upgrade work will only be possible if the cost of repayments can be spread over a long period of time, such as between ten and twenty years. This length of repayment, in turn, will only be viable if the cost of the finance is as cheap as possible. Hence the importance of the green bonds.

How might a typical home be improved?

In order to keep program overhead costs as low as possible, a certified contractor who would hope to make sales would initiate the process by performing a home energy assessment, to assess the most cost effective measures to achieve the customer’s requirements. The staff performing the assessment would have to be trained and certified to administer an approved home assessment. The assessor would look for all electricity, gas, oil and solid fuel savings, regardless of the customer’s utilities. To the extent possible, the customer's previous energy bills would be analysed to provide a more accurate savings estimate. The homeowner would then be advised on a range of options for improving the building's performance, such as wall, roof and floor insulation, draught-proofing, air-tightness detailing, an effective designed ventilation system, boiler upgrade, heating controls, double or triple glazing and renewable energy systems. The assessment would include that contractor’s price for installing all measures so that the customer could make an informed decision without any additional effort.

The key to this programme is that the contractor would be able to make a unique PAYS offer that almost every customer including tenants would want to accept. Customers would be able to install measures without any upfront payment. Independently verified savings estimates would document that the customer would receive immediate positive cash flow. The installation would not add to the customer’s personal debt (as the obligation is assigned to the location) and the customer would be assured they will only pay as long as they save. If a measure fails and is not repaired, the customer’s payment obligation ends. Any needed repair would not increase the monthly payment amount (only the payment term would be extended). If the customer left the premises, their obligation to pay would end. Customers would be offered risk free installation of efficiency measures.

Customers who want to install measures that are not sufficiently cost-effective to provide this level of savings under current rates could use bridging finance – such as a grant or personal savings – to pay for that portion of a measure’s cost that prevents the measure from qualifying for the tariff. PAYS can be a very flexible mechanism to help all kinds of customers including tenants, landlords, developers and builders to purchase and install efficiency measures and renewable energy technologies.

An optional BER assessment could be conducted upon completion with a BER certificate issued for the home. Great care should be taken to ensure that the occupants’ health and comfort is enhanced by any upgrade work – this should be a prominently stated principle of the whole PAYS proposal. Radon levels could also be measured at a very low cost as part of the energy assessment.

What would the construction industry have to do to prepare for this?

The industry would have to up-skill in several ways. Take the residential market. Contractors would need to hire energy assessors with the knowledge to advise homeowners of the most appropriate options for their specific home. Builders would have to up-skill in two ways – both in their technical abilities, and their ability to work in an existing home, with all of the challenges that this presents. The training and ramping up of reliable companies to do this volume of work properly should not be underestimated – this is a homeowner’s service industry, and not a simple building process. The work is done with people occupying their homes and there are health and safety issues as well as contents protection issues – things most builders are not good at. The experience gleaned from the Home Energy Saving and Greener Homes schemes will help with some of this, but it should be expected that PAYS would take several years to ramp up fully, due to the extent of training and investment in new staff and equipment required.

Should PAYS be tied to a building or a building occupant?

The experience with PAYS in the US indicates that the contract should apply to the building. This approach is also being advocated for PAYS in the UK. Tying the loan to a building can help address the split incentive issue, in that a given tenant of the building would happily sign up for PAYS (landlord consenting, obviously) if they realised they had no debt obligation, and that their repayments would cease if and when they moved, with the next tenant taking over the repayments. It also addresses the concerns of any customer who may not be sure how long they will remain at their home (due to age, employment, family issues, and so on).

Would energy companies be willing or able to spread the repayments over sufficiently long periods to enable more significant energy upgrades?

Right now, energy companies are already in the business of investing long term in plant to meet customers’ energy needs. Investments such as power lines, gas lines, power plants and wind farms are being made by energy companies all over the world, many being amortised over thirty years.

Many PAYS projects could be financed in fewer than ten years. Compared to the investments in plant and transmission associated with watts and therms, these investments in negawatts and negatherms would be considered short term. More importantly, as opposed to a single investment in plant that can create major liabilities if there are structural, political or regulatory problems, PAYS investments would be spread out all over Ireland so that no one problem would be significant.

Should the utilities wish to finance PAYS projects, they can easily recover 5-6 per cent on an eight year investment with their return on principal and interest guaranteed by all their ratepayers. The ability of computers to record and keep track of each individual customer’s project and the guarantee they can transfer payment obligations to successor occupants would ensure that records keeping is not a problem.

Perhaps they may be attracted by charging more for longer term repayments. So for instance, a e5,000 upgrade could be billed at e875 per annum over six years (therefore earning the energy company/lender an additional e250 or 5 per cent return). A e20,000 upgrade could be billed at e1,200 per annum over 20 years, earning the energy company/lender an additional e4,000, or 20 per cent return.

Perhaps energy companies may be suitably attracted by the prospect of tying customers or buildings to long-term contracts. This area needs to be explored in terms of the scope for committing customers to contracts with one supplier. Whilst energy companies aren’t permitted to tie customers to lengthy contracts for energy supply, perhaps they could be allowed to set in place more binding contracts for repayments of energy upgrade measures, whilst still giving people the freedom of switching energy supply as long as the original energy supplier’s investment in resource efficiency, their investment in the customer, is repaid.

To what extent would PAYS engender loyalty in customers to their energy supplier?

Suppose a customer was offered PAYS by their energy supplier, resulting in noticeable benefits to the occupant’s quality of life – increased comfort, noticeable health improvements, reduced carbon tax exposure and reduced energy bills, improved asset value of the house (in the case of the homeowner), and a satisfaction at becoming greener. This might make them more likely to stay with their energy supplier.

A diagram of some of the range of measures which could qualify for PAYS

PAYS & carbon tax: a carrot and stick approach

The introduction of a carbon tax alone could be highly unpopular with many people – particularly those people for whom green issues and climate change are not high priorities. To be effective, the ‘stick’ that a carbon tax represents should be complimented by a ‘carrot’. To a person living in an uninsulated home using home heating oil, a carbon tax may seem unfair in light of their already considerable energy costs. If they can avail of an energy upgrade through their electricity or gas bill, they’ll have a means of reducing their carbon tax bill – especially given that the carbon tax is likely to be channelled through existing systems like energy bills.

The carbon tax and PAYS are therefore mutually beneficial: a carbon tax would encourage people to look at ways of cutting their energy consumption, and the opportunity to reduce carbon tax costs through PAYS would remove reasonable objections to such a tax. It’s difficult to object to a carbon tax if you have a means to reduce your carbon tax bill, whilst making your home more comfortable, healthy, more valuable and cheaper to heat. For the same reason, the introduction of PAYS would give the state more leverage to increase carbon tax rates over time, at least insofar as it relates to energy usage in buildings. Increasing the carbon tax rate would therefore either directly increase the monies coming into the exchequer through carbon tax, or increase the number and extent of upgrades under PAYS, thereby benefiting the exchequer in terms of VAT payments and other taxes associated with the construction work. More research may be needed to predict the benefits to the Irish economy of reducing monies leaving the economy to buy imported energy. How much of that saved money would be spent in Ireland? How much tax would this bring into the public coffers?

1 Pay as You Save and PAYS are registered trademarks

2 The UK PAYS report recommends that participating homeowners be billed through local authorities rather than energy companies. This may be more achievable in the UK, where homeowners are used to being billed by local authorities. Whilst this shouldn’t be ruled out in Ireland, it may prove less attractive than using energy companies both from a promotion and billing point of view. Psychologically, it may be much more attractive for homeowners to repay for upgrade measures and pay for energy in one bill. The report can be downloaded from http://tinyurl.com/ukpays

3 See http://tinyurl.com/energyreduction to access the EDRT consultation document. Submissions must be lodged by 30 September

4 In the case of CHP or a more conventional generator, in either case typically only in commercial or industrial buildings

5 World Energy Outlook 2006, International Energy Agency

Related items

-

EIB Group support new low-cost home energy upgrade scheme in Ireland

-

Ireland joins whole life carbon data initiative

-

WorldGBC launches green building policy principles for governments

-

Retrokit tailors software platform for one-stop-shops

Retrokit tailors software platform for one-stop-shops -

Cuckoos & magpies: state house-buying hits record

Cuckoos & magpies: state house-buying hits record -

Blind & shutter group calls for Part B changes

Blind & shutter group calls for Part B changes -

Wales votes to cut emissions 80%

Wales votes to cut emissions 80% -

Filling the retrofit policy void

Filling the retrofit policy void -

Water, water, everywhere, nor any drop to drink

Water, water, everywhere, nor any drop to drink -

Policy for zero, or zero policy?

Policy for zero, or zero policy? -

Why construction contracts must change in light of Grenfell

Why construction contracts must change in light of Grenfell -

Government ‘Help to hoard' scheme - why we’re not building homes

Government ‘Help to hoard' scheme - why we’re not building homes