- Blogs

- Posted

Why housing isn't viable

It is simply not possible for developers to build housing in cities like Dublin and sell it for a reasonable price without making a loss, writes architect Mel Reynolds — instead, we need meaningful affordable housing schemes.

This article was originally published in issue 24 of Passive House Plus magazine. Want immediate access to all back issues and exclusive extra content? Click here to subscribe for as little as €10, or click here to receive the next issue free of charge

Many people are scratching their heads looking at the housing sector. Some say residential building isn’t economically viable, but double digit increases in sales prices and rents would suggest the contrary, particularly in Dublin. Well, think again.

A recent study by the Society of Chartered Surveyors Ireland (SCSI) confirmed that high site prices when factored into costs made most residential schemes, even in areas of high demand in Dublin, unviable. The report suggested that most developments were aimed at the top 20% of earners, and that site costs and profit, not construction costs, were the culprits. Site values and developer’s profit account for 35% of a typical sales price.

When looking at the feasibility of projects a critical component is the site value. Developers work this out in a simple equation: take a typical dwelling sales price in the area, deduct all relevant costs, taxes, levies and profit margin, and the ‘residual’ figure is the site value, or what they can afford to pay for the site. If you pay more than this figure for the site, profit margins are impacted upon. Pay less and there is more profit there. Increasing height also adds to profit (discounts are not passed on).

There is an art to this and in practice there is a delicate balance between paying a little more, planning risk, development risk (costs) and price expectations. This may sound deceptively simple, but the road is littered with the corpses of many would-be developers.

There are two recent examples worth looking at, one in outer Dublin and one in the city’s docklands.

Outer Dublin: Tallaght

In November, the commercial property company Green Reit sold 63 apartments in Tallaght for €9.25m (average €147,000 per two-bed unit). The company returned a handsome profit of 140% in the three years since it originally purchased the apartments.

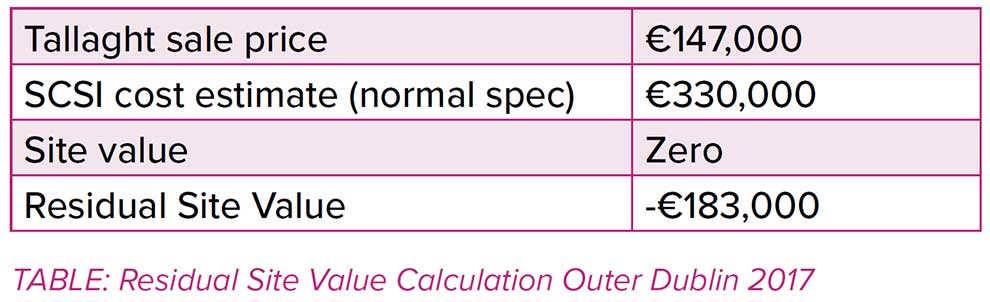

The SCSI suggest that an apartment in this location would need to sell for €330,000 all in (with a zero site value). But the residual site calculation is as follows:

A negative site value means that even if gifted the site the developer would make a loss. Double the height and the loss doubles. Removing car parking spaces and making the apartments smaller would reduce costs by €40,000 — still some distance to breaking even.

An investor is better off buying secondhand and renting it out straight away. No carry cost, no development risk, no architects, engineers, planners or builders to deal with, and apartments at less than half the price of building. Or they can take the risk to develop luxury apartments for twice this normal sales price, with all the headaches.

Central Dublin: Docklands

NAMA are selling 124 apartments in North Bank, Dublin 1 for €33m (average price €254,000 per two-bed unit excluding a ground floor commercial element).

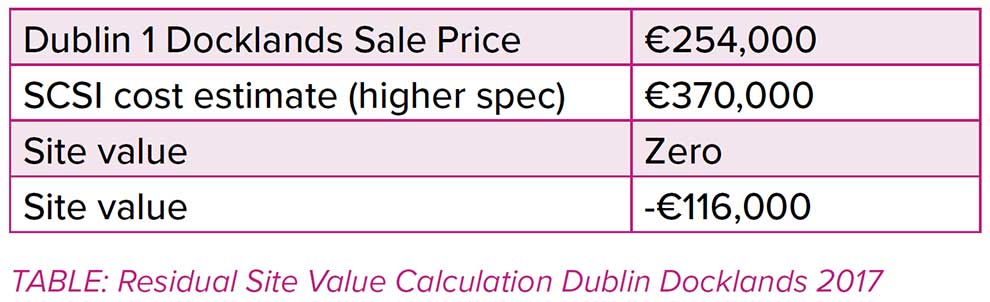

The SCSI suggest an apartment in this location would need to sell for €370,000 all in (with a zero site value). The site calculation as follows:

Even in this central location there is a negative site value — the development would make a loss. As with the previous example cost-cutting makes little difference and sales prices would need to be twice this purchase price to stack up.

What these simple examples demonstrate is that even at lower construction costs, the viability in these locations suggests zero site values for residential, let alone the €100,000+ per site that some locations are achieving.

Alternative uses

‘Innovative’ uses such as co-housing, executive hubs, studios (bedsit), live-work office pods and other short-term accommodation are very lucrative. But, in turn, this inflates their site prices and makes residential construction unattractive. Why build apartments when you can make more money from student housing?

Some students will leave existing rented properties to go into bespoke student housing, and inward migrating executives may avail of ‘live-work’ office pods. But families seeking affordable housing and rentals will see little in the way of new homes in Dublin to cater for their demands.

"Why build apartments when you can make more money from student housing?"

Alternative uses other than traditional apartments make sense in most locations. Offices, and short-term commercial uses like student housing, hotels and hostels in these locations are renting for twice permanent residential housing rents. Some central student housing sites have changed hands this year for the equivalent of more than €100,000 — three student bedrooms is the equivalent space of a large apartment.

The only viable residential developments in Dublin are luxury high-end schemes that are severely unaffordable.

The government needs to introduce an official definition of affordable housing and a meaningful affordable housing scheme. An affordable family home should sell for no more than €240,000, the maximum price an average full time and part time salary can reasonably afford in mortgage repayments.

Co-ops can deliver homes (privately funded) at below this level in outer Dublin suburbs, but are entirely dependent on discounted land being made available from local authorities.

Anticipated official policy intended to reduce apartment sizes and squeeze in higher numbers of ‘build-to-rent’ units is counter-productive, as it will only inflate site values and further impact residential viability. Residential developments in areas where alternative short-stay uses are permitted will continue to be aimed at the upper end of the rental and sales market.

The majority of prospective home owners, those earning less than €70,000 combined household income, must be wondering what other new ‘innovations’ are coming down the tracks? In the meantime, keep scratching your heads.